Table of Contents

How to Invest in Stocks When Interest Rates Decrease?

Investing in stocks can be a rewarding way to grow your wealth, and understanding how to navigate different market conditions is essential for success. One crucial factor that affects the stock market is interest rates. When interest rates decrease, it creates both challenges and opportunities for investors. In this comprehensive guide, we will explore strategies and considerations for investing in stocks when interest rates are on the decline.

Introduction

Before delving into the specifics of investing during a period of decreasing interest rates, it is crucial to understand the relationship between interest rates and the stock market. Interest rates, determined by central banks, influence borrowing costs, economic growth, and investor sentiment. When interest rates decrease, it often stimulates economic activity and affects various sectors, including stocks.

Understanding the Impact of Decreasing Interest Rates

Impact on Bond Yields and Stock Valuations

As interest rates decrease, the yields on bonds also decline. Bonds with fixed interest rates become more attractive as they offer relatively higher returns than other investment options. Consequently, investors might shift their focus from stocks to bonds, causing a decline in stock prices. This phenomenon is especially noticeable in sectors that are interest-rate sensitive, such as utilities and real estate.

Stimulating Economic Growth

When interest rates decrease, it can stimulate borrowing and spending, leading to increased economic activity. As businesses and consumers have easier access to credit, companies’ profitability might improve, positively impacting stock prices. Sectors like consumer discretionary and technology tend to benefit from increased consumer spending and business expansion during such periods.

International Investments

Interest rate changes in one country can affect global markets. Decreasing interest rates in a particular country can attract foreign investors seeking higher returns. This influx of capital can strengthen the local stock market and provide investment opportunities for international investors. Therefore, keeping an eye on global interest rate trends is crucial when considering stock investments.

Strategies for Investing in Stocks When Interest Rates Decrease

1. Focus on Dividend-Paying Stocks

During periods of declining interest rates, dividend-paying stocks can become more attractive to investors seeking income. Dividends are a portion of a company’s profits distributed to shareholders, and they can provide a stable income stream. Look for companies with a track record of consistent dividend payments and sustainable payout ratios. Dividend aristocrats, companies with a history of increasing dividends for many years, can be particularly appealing.

2. Identify Growth Opportunities

While some sectors may experience temporary setbacks due to decreasing interest rates, others can thrive. Low interest rates can boost consumer spending and borrowing, benefiting sectors like consumer discretionary, technology, and healthcare. Identify companies with strong growth potential within these sectors and conduct thorough research to assess their long-term prospects.

3. Diversify Your Portfolio

Diversification is a fundamental principle of investing. When interest rates decrease, different sectors and industries may be affected differently. By diversifying your portfolio across various sectors, you can mitigate risks and capitalize on opportunities. Consider investing in a mix of growth stocks, dividend-paying stocks, and other asset classes like bonds and real estate investment trusts (REITs).

4. Keep an Eye on Central Bank Policies

Monitoring the actions and statements of central banks is crucial during periods of changing interest rates. Central banks play a significant role in shaping monetary policy, and their decisions can have a profound impact on financial markets. Stay informed about interest rate announcements, economic indicators, and policy changes to make well-informed investment decisions.

5. Maintain a Long-Term Perspective

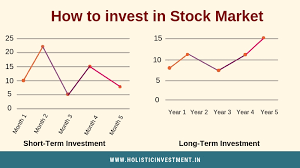

Investing in stocks should always be approached with a long-term perspective. While interest rate fluctuations can create short-term volatility, it is essential to focus on the underlying fundamentals of the companies you invest in. Quality companies with strong competitive advantages and solid growth prospects can weather market fluctuations and generate substantial returns over the long run.

Conclusion

Investing in stocks when interest rates decrease requires careful consideration and a well-thought-out strategy. By understanding the impact of decreasing interest rates on different sectors, identifying growth opportunities, diversifying your portfolio, staying informed about central bank policies, and maintaining a long-term perspective, you can navigate the stock market successfully. How to Invest in Stocks

Remember, investing always carries risks, and it is advisable to consult with a financial advisor or conduct thorough research before making any investment decisions. With diligent analysis and a disciplined approach, you can position yourself to take advantage of the opportunities presented by decreasing interest rates.

Invest wisely and embrace the potential that investing in stocks during periods of declining interest rates can offer.